Author: John Pugliano

-

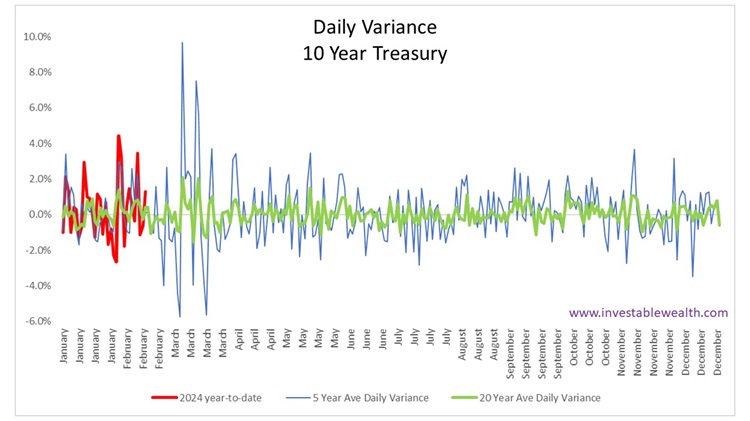

Expect MORE Volatility 240220

The Market is starting to second guess an imminent interest rate cut. Core inflation is not receding as housing and labor costs continue to rise. Headline inflation is also creeping back up as missile attacks in the Red Sea drive oil and shipping costs higher. Stock market volatility is starting to pick up, but it…