Headlines are written with the intent to be provocative and incite fear. It’s not easy to identify the real boogeyman. So given the crisis du jour, what should you be afraid of?

The debt cycle isn’t even close to peaking. Delinquency on credit card, mortgages and home equity loans are all at moderate levels. Auto loan delinquency is elevated but not yet at extremes. Student loan delinquency is high but it’s a benign threat to the financial sector because the debt is ultimately guaranteed by the Federal Government. Eventually the debt cycle will run its course and the bubble will pop…I don’t think we’re there yet.

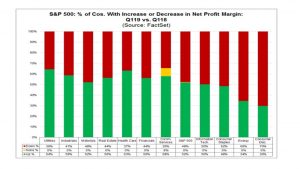

Despite the dire predictions of a 19Q1 “earnings recession”…it didn’t happen. All but three S&P500 sectors have reported that 50% or more of their companies had an increase in net profit margin.

Over the past week, the AAII Investor Sentiment Survey flipped- more people are now BEARISH. Probably a good contrarian indicator that it’s time to buy.

For now, I think the biggest threat to the stock market isn’t the Trade War but a conflict with Iran that disrupts or otherwise threatens oil tankers in the Persian Gulf.

——————————————————————————

The Robots are Coming: A Human’s Survival Guide to Profiting in the Age of Automation available at AMAZON and all fine bookstores.

——————————————————————————

Listen to the Wealthsteading Podcast to receive updated market commentary:

The 10 Wealth Building Principles can be heard at:

http://www.wealthsteading.com/category/wealth-building-principle/

Subscribe to the Wealthsteading Podcast:

via iTunes: https://itunes.apple.com/us/podcast/wealthsteading-podcast/id896417058