S&P500 is poised to close out the week up more than 4%. Why?

- Mexican tariff fear is abating. No surprise, Mexico will take action (or at least say they will) to curb migrants entering their southern border.

- The May job’s report was weak, leading some to believe that the Federal Reserve will cut interest rates.

The bottom line is that markets like easy money. Lower interest rates encourage consumers to spend. A lower US Dollar eases Emerging Market debt that’s denominated in US currency. The global economy is based on debt and cheaper rates fuel consumption.

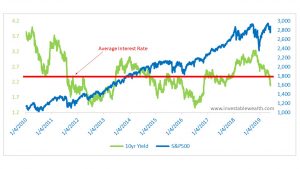

Some pundits are complaining that lower 10 Year Treasury yields are a sign that the economy is slowing too dramatically and we’re headed for recession. I disagree. The attached chart shows that current rates have dropped only slightly below the long term average. Also note that over the past decade, as rates approached 3% the economy stalled, but once rates were reduced, the S&P500 went on to make new highs.

On an unrelated topic- this week the AAII investor sentiment survey registered a Bearish 42.5, the highest negative rating since the December 2018 meltdown…surely a contrarian sign that the market has bottomed.

——————————————————————————

The Robots are Coming: A Human’s Survival Guide to Profiting in the Age of Automation available at AMAZON and all fine bookstores.

——————————————————————————

Listen to the Wealthsteading Podcast to receive updated market commentary:

The 10 Wealth Building Principles can be heard at:

http://www.wealthsteading.com/category/wealth-building-principle/

Subscribe to the Wealthsteading Podcast:

via iTunes: https://itunes.apple.com/us/podcast/wealthsteading-podcast/id896417058