Tag: Buy the DIP

-

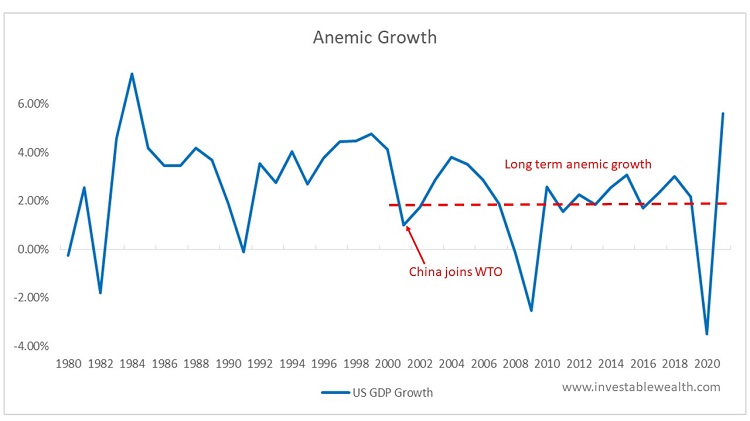

Anemic economy will shackle FED

The Stock Market has started out the year horribly, in fact, the worst ever. The selloff is due to the double whammy of Omicron and fears about the Federal Reserve raising interest rates. Neither issues concern me. Omicron is clearly dissipating (epicenter UK has lifted restrictions) and the FED can’t significantly raise interest rates because…